Insight into Engage Investments…

Firstly, I’ll start with some excellent news.

Our portfolio, Engage Tracker 100 has just hit its five-year milestone and taken the #1 spot on Morningstar’s comparison tool with an impressive 12.79% annualised return over 5 years.

This is one of our selection of portfolios that have been designed with our investment partner, Timeline. and together we believe they will continue to offer excellent real world returns for the families we look after.

The ‘100’ in the portfolio name relates to the fact that this portfolio has a 100% allocation to equities. It has sector & regional diversification with nearly 5,000 companies across the globe. It’s worth noting that this investment strategy is continued throughout our portfolios, even with different levels of equity content – for example we have portfolios with 50% up to the 100% above. The other percentage that isn’t equities is global bonds.

In our 100% equity portfolio. 65% is allocated to North America, 12% to Emerging Markets, 11% to Europe, 8% to Asia and 4% to the UK and this broadly represents the global equity market splits. Our portfolio cost is 0.14% which is really competitive, and low fees means there is a low barrier to generating returns for the families we look after.

The funds we use inside the portfolio are what’s known as ‘trackers’ as they track market returns, rather than us choosing funds with a manager who is picking the individual investments and trying to ‘outperform’ the markets.

The theory of ‘outperformance’ is good, who wouldn’t want to outperform? The reality is that it’s very difficult to do so on a consistent basis. You may well find a manager who outperforms in any one year, in fact probability suggests you will from time to time. However, when you zoom the timeframe out, it becomes harder and harder to outperform tracker funds. This is what the long term evidence suggests and this allows us to focus on financial planning, rather than who is going to outperform this year.

We are really proud of the investment portfolios we have chosen for clients, we’re proud of how our clients have stuck with them through some difficult periods since we launched in 2017.

We have had Brexit, Covid, Tech crash in 2022 and Trump tariffs in 2025 and still we show positive market returns and excellent investor behaviour.

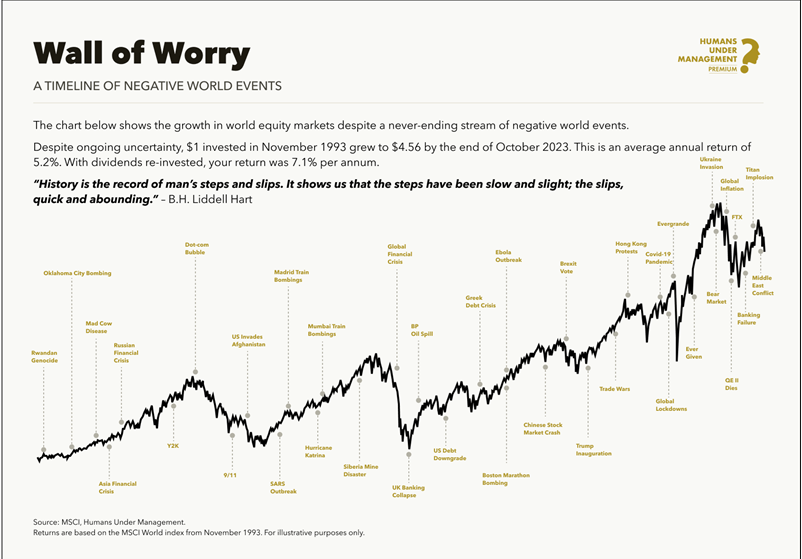

The volatility of markets is ALWAYS there. The wall of worry below shows that this has been the state of the world for the past 50 years plus. Real risk would have been sitting in cash and losing against inflation during this period. Some would have lost out on millions in both returns and purchasing power throughout that period. This is why we help families through the volatility and to find the balance between safety and real risk!

You can think you’re being safe by staying in cash, but over the long term this is a huge risk due to the erosion of your purchasing power due to inflation. People NEED returns on their hard-earned capital and we want to make sure they achieve this.

If you’d like a second opinion on your portfolios or on your financial plan, please do get in touch.